Abu Dhabi's cultural future is taking shape.

On Yas Island, we may now know the location of Disneyland Abu Dhabi after a post from the company's chief executive. Bob Iger posted from the location of the upcoming theme park last week, teasing its whereabouts, despite the fact that it is yet to be officially announced.

And on Saadiyat Island, as we're finding at the newly opened Natural History Museum Abu Dhabi, our past is often the most useful lens for understanding where we're going – and will take a collective effort to grasp fully.

That much was made clear in a conversation between museum director Peter Kjaergaard and Lori Bettison-Varga, president and director of the Natural History Museum of Los Angeles County, as they spoke to The National's Faisal Al Zaabi while walking around the Abu Dhabi institution’s galleries.

Etched into one of the museum’s walls is a quote by UAE Founding Father, the late Sheikh Zayed bin Sultan Al Nahyan, which Kjaergaard describes as foundational rather than symbolic. “On land and in the sea, our forefathers lived and survived in this environment,” the quote reads.

Kjaergaard says: “They were able to do so because they recognised the need to conserve it, to take from it only what they needed to live, and to preserve it for succeeding generations.”

While one of the world's most impressive collections of dinosaur bones might get many through the door, the museum will also play a key role in education and preservation. That is made clear through its international partnerships, such as the burgeoning relationship with the Los Angeles museum.

That will include Abu Dhabi's participation in the City Nature Challenge, a global initiative that invites residents to document urban biodiversity using the iNaturalist app.

The crowdsourcing initiative, Kjaergaard hopes, will help scientists understand Abu Dhabi's natural world now to better understand what it's becoming.

“The world is still changing,” he says. “We need to monitor this. We need to keep an eye on what is actually happening.”

While Kjaergaard's journey in Abu Dhabi is just beginning, a chapter at one of Saadiyat Cultural District's best-loved institutions is coming to a close.

Manuel Rabate, director of Louvre Abu Dhabi, will be moving on to his next challenge after 10 years with the institution, becoming chief executive and director of the Kiran Nadar Museum of Art in Delhi, India.

“I came with my family to Abu Dhabi to work and to open Louvre Abu Dhabi more than a decade ago," Rabate tells The National. "And I'm very proud of the achievement and of offering this incredible universal museum to the world.” In his opinion, the museum has “changed the experience of Abu Dhabi for visitors and residents”.

He adds: “I believe this experience of opening and operating a museum in all its dimensions is what I will bring to the Kiran Nadar Museum of Art: the ability to make it a reality. I hope I'll be remembered as a man capable of bridging all the cultures of the world, of always having local relevance and international reach.”

What Rabate has helped to build since the museum opened in 2017 is greatly appreciated in the emirate and across the world. Louvre Abu Dhabi has become a cultural beacon and a foundational template on which institutions such as the Natural History Museum, Zayed National Museum and the upcoming Guggenheim Abu Dhabi will continue to build.

We've been lucky to have him with us, and I know many of you will join me in thanking him for his myriad contributions and wishing him the absolute best in his journey forward.

If you happen to see him before he leaves in March when you're visiting the stellar Picasso, the Figure exhibition, be sure to express those sentiments in person.

Wicked composer confirms Oz sequel film in the works

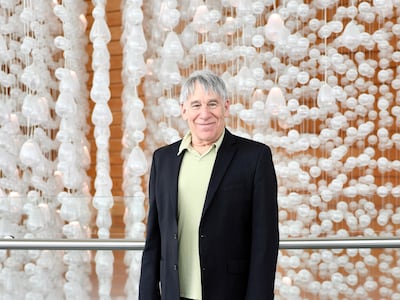

Stephen Schwartz will never be done with Wicked. It is more than his most famous creation – it has become who he is. His memoir is even titled Defying Gravity.

The American composer, 77, was reflecting on that backstage at Dubai Opera before the musical’s UAE premiere.

More than two decades after Wicked first took flight, Schwartz is still deeply embedded in its world, having only recently returned to write new material for Wicked: For Good, the second part of the film adaptation.

For Schwartz, Oz – creatively, commercially, spiritually – is a path paved in gold. And it's one he continues to shape, question and return to.

After months of speculation, he reveals to The National exactly where his next steps could lead: a follow-up musical film to Wicked and The Wizard of Oz. Based on the second book in L Frank Baum's series, the story is centred on Princess Ozma – one of the over-arching pivotal characters.

Schwartz is developing the project, tentatively titled Ozma, with his longtime collaborator Winnie Holzman. For Wicked, Schwartz wrote the music and lyrics, while Holzman wrote the book – a dynamic they're set to continue.

Find more from our exclusive here.

Shamsa Al Omaira's solo exhibition looks beyond grief

How does creating art help with grief?

The Hard like Tears, Soft like Glass exhibition at Iris Projects in Abu Dhabi seeks to answer this question. The first solo show by Emirati multidisciplinary artist Shamsa Al Omaira since 2012 is about family, memories and the emotional architecture of domestic life.

Al Omaira’s work is deeply personal. It maps the patterns that emotions leave behind. “I always try to document certain things, whether it’s emotions, thoughts or human behaviour,” she explains. “I love creating patterns out of what we experience as humans and this is where my work is going.”

The exhibition is the result of a one-year mentorship programme with curator and critic Nadine Khalil.

The exhibition has an emotional trajectory that moves through grief, understanding and joy. “Somehow it’s intentional,” Al Omaira says. “I feel the most change that has happened to me is through my healing journey. We go through grief. We go through loss. We go through experiences and it does shape us.”

Find more here.

Dates for your diary

- Mariah Carey at Saadiyat Nights, Abu Dhabi – February 7

- Vivaldi by UAE Natural Orchestra at NYU Abu Dhabi – February 7

- Buena Vista All Stars at Bla Bla, Dubai – February 8

Other highlights

The National produces newsletters across an array of subjects. You can sign up here.